How to apply PFC tax saving capital gain bonds online | How to apply PFC 54ec bonds online - YouTube

How to apply PFC tax saving capital gain bonds online | How to apply PFC 54ec bonds online - YouTube

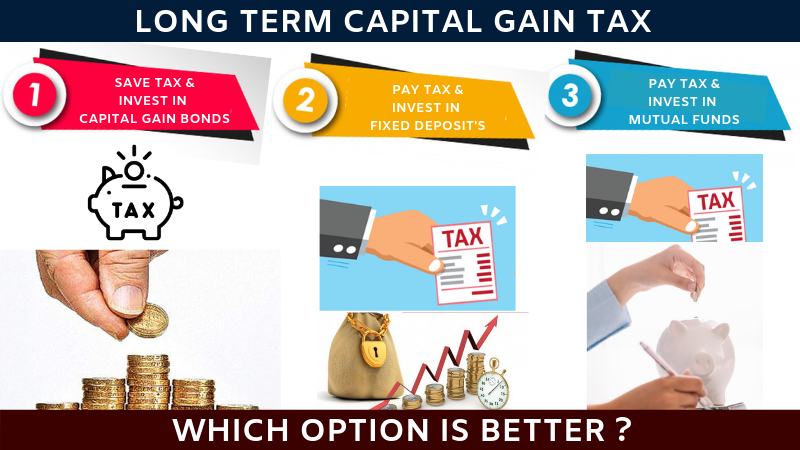

яαנєѕн кαтнραℓια ,CFP® on Twitter: "Save long-term capital gain tax through #54EC Bonds ...! Save Tax & earn interest on your long term Capital Gains. https://t.co/j9c9HrU38t" / Twitter

How to save Long Term Capital Gain Tax u/s54EC|How to apply for REC and NHAI Bonds in Offline Mode| - YouTube

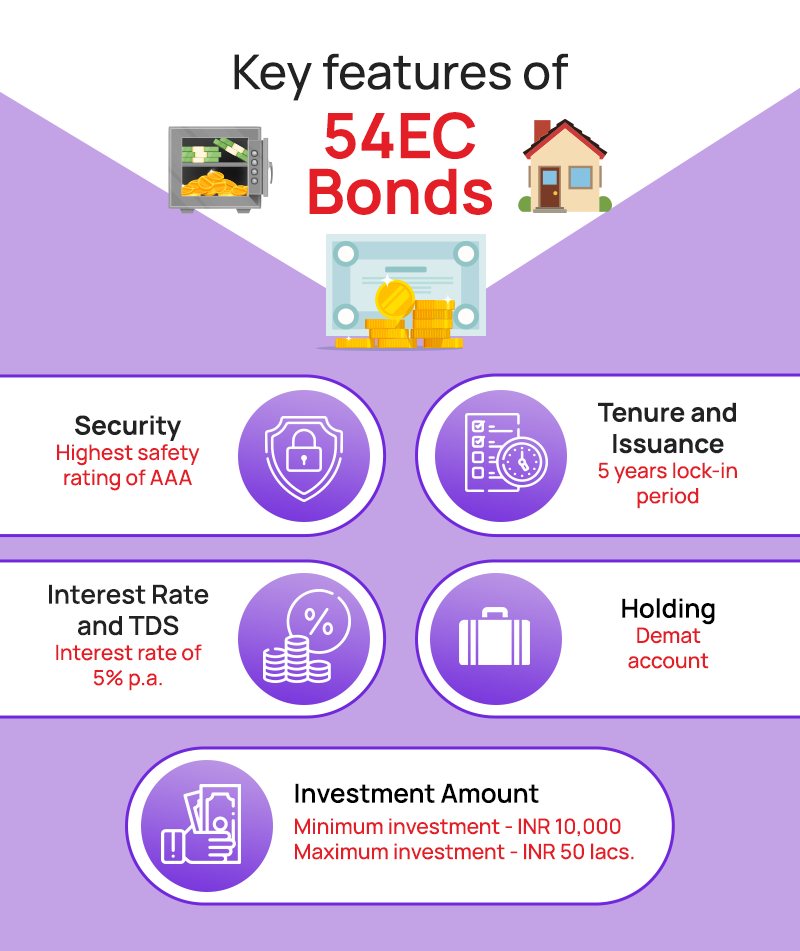

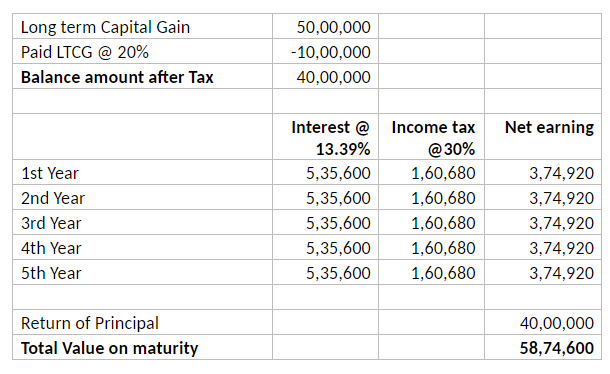

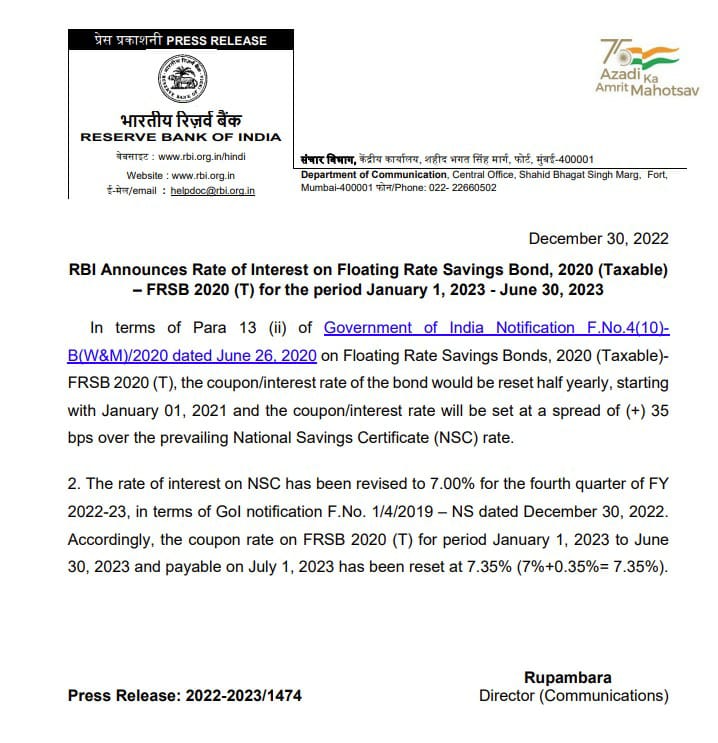

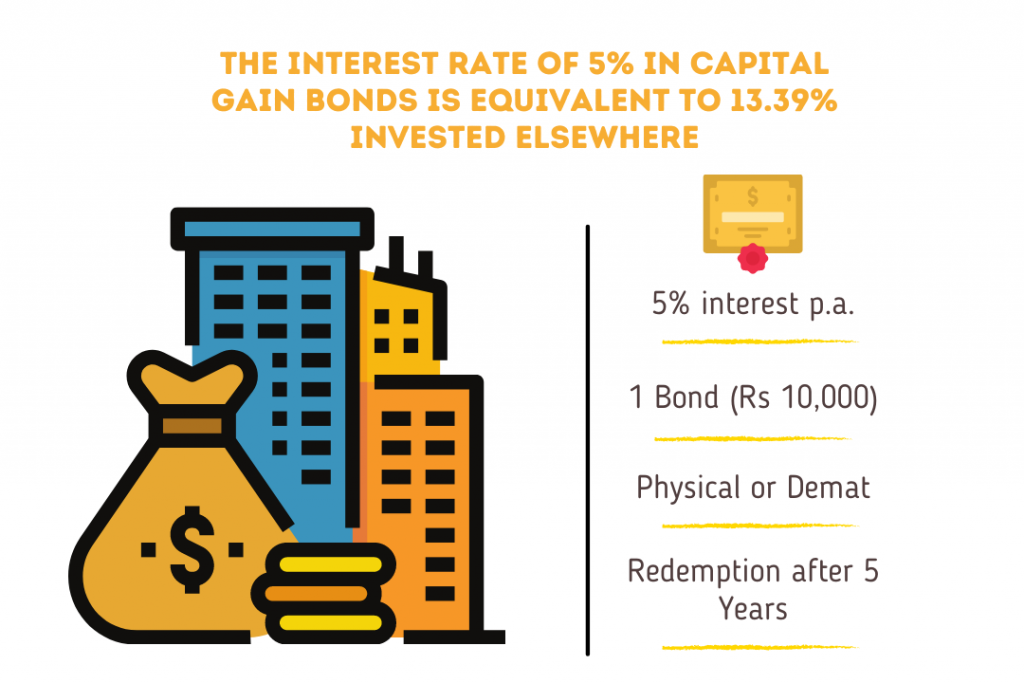

Before investing in capital gain bonds, there are a few things you should know. | by RR Finance | Medium