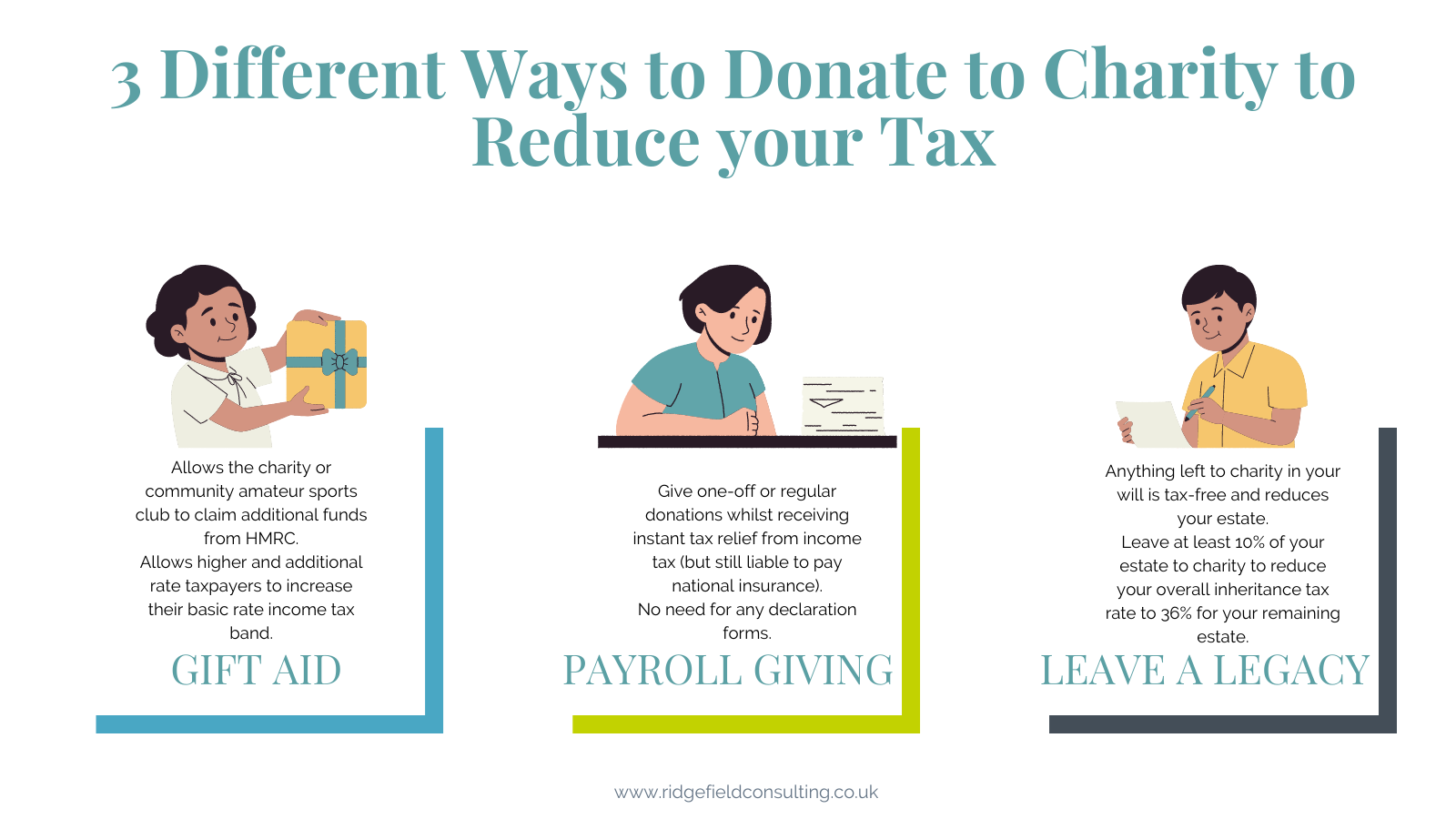

Why your donors might benefit from Gift Aid carry back – it's not too late to make a charitable gift in the 2022-23 tax year

What is Gift Aid? Gift Aid allows St Ebbe's to claim, from HM Revenue & Customs (HMRC), the basic rate of tax on a donatio

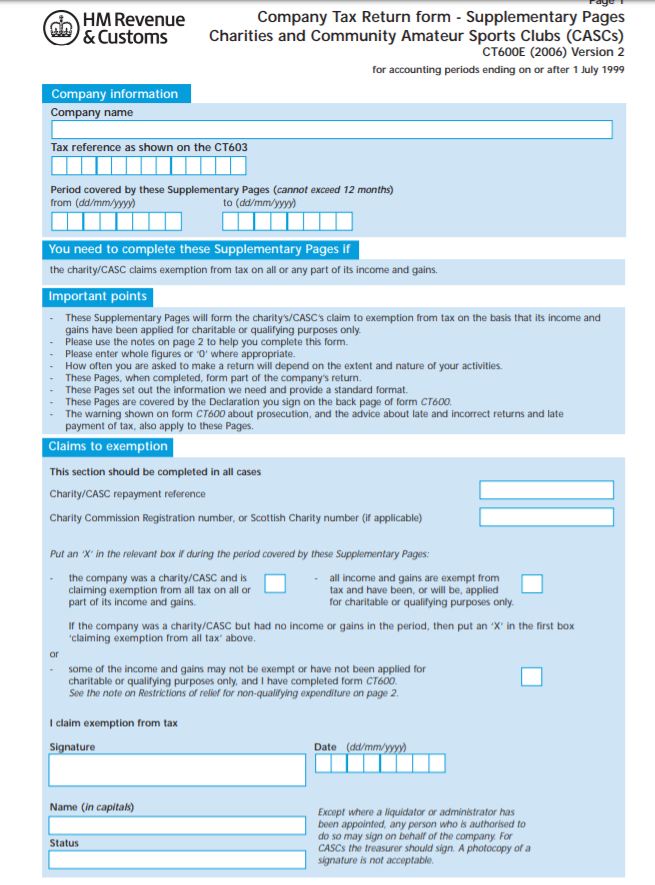

GitHub - JustinBusschau/hmrc-gift-aid: A library for charities and CASCs to claim Gift Aid (including Small Donations) from HMRC

GIFT AID FAQ's What is Gift Aid? Gift Aid is a government scheme which is open to all charity supporters who pay UK Income and

.png?sfvrsn=de2b4b47_0)