Understanding the UK Capital Gains Tax Allowance Reduction and Its Impact on Crypto Investors | Recap Blog

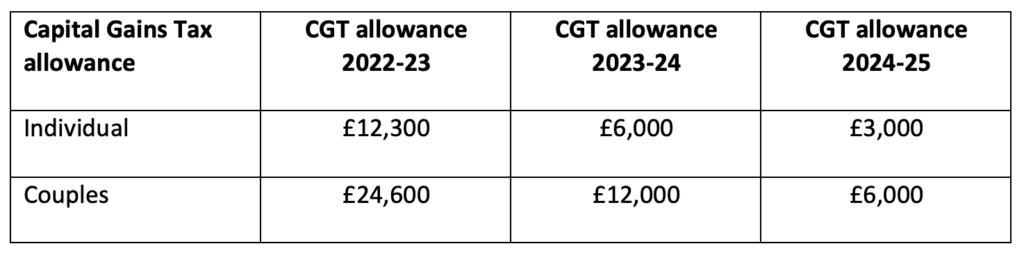

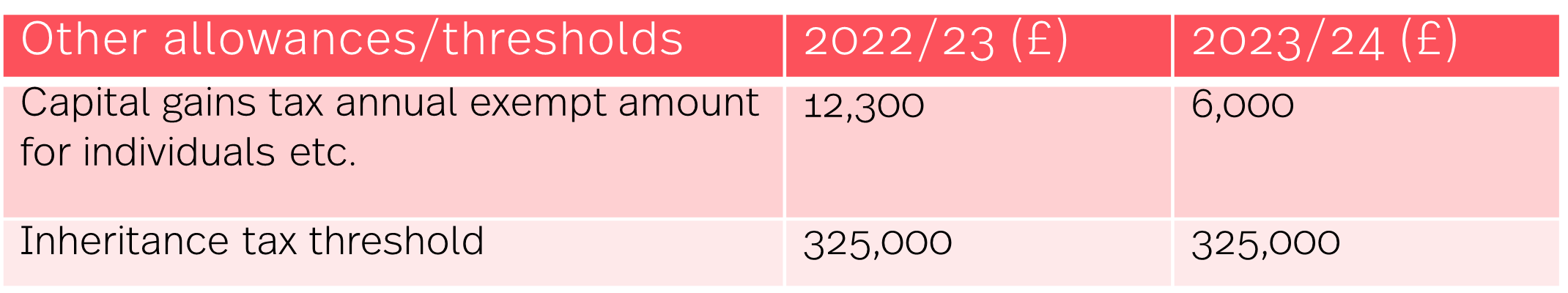

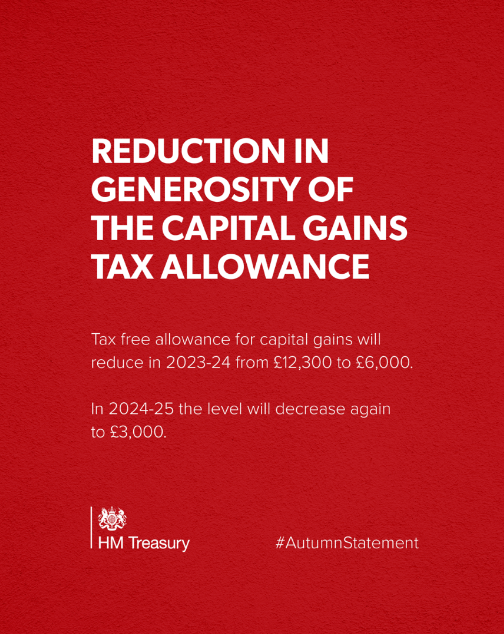

HM Treasury on X: "To restore public finances and make the tax system fairer, tax free allowance for capital gains will reduce in 2023--24 from £12,300 to 6,000 and again to 3,000

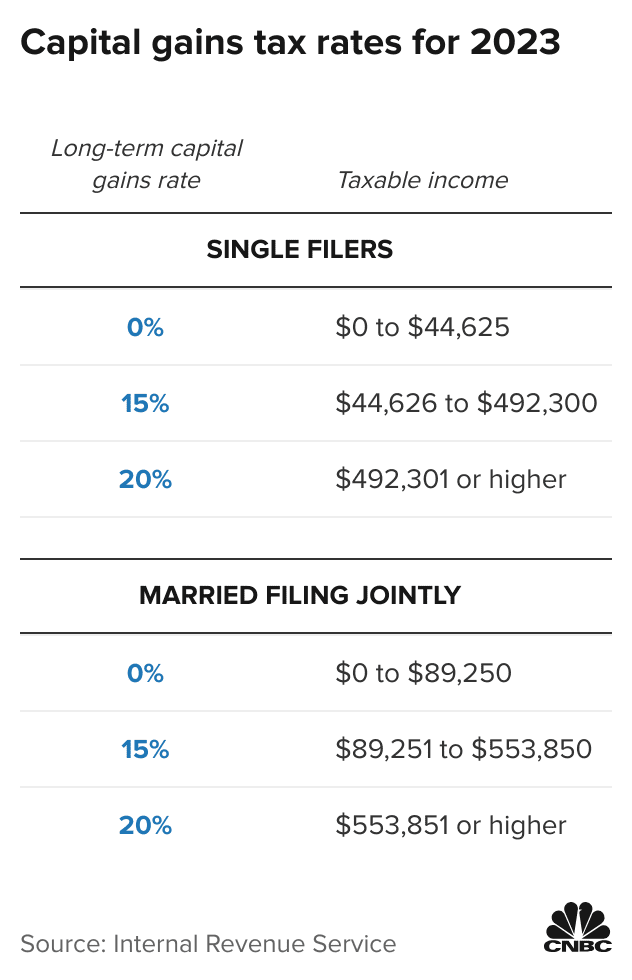

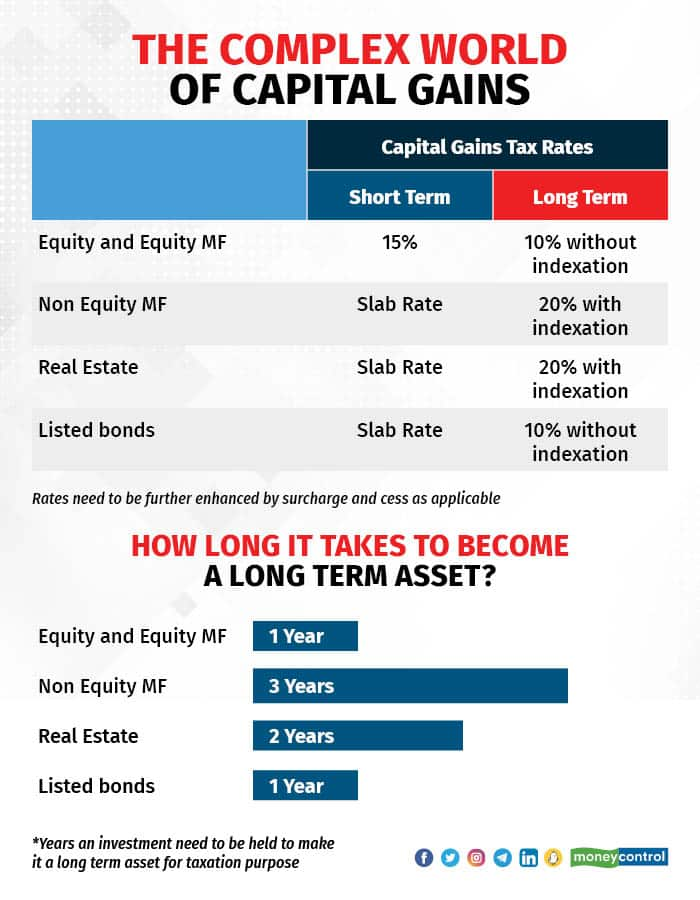

:max_bytes(150000):strip_icc()/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)